When buying gold as an investment, buyers naturally have one eye on a potential future sale. The intention is to make as much profit as possible, particularly during times of economic strife. At this time of high inflation, you will want to maximise your return on investment.

In this article, we will outline the Capital Gains Tax (CGT) implications of selling gold in 2022 and explain how you can buy gold Capital Gains Tax-free.

What is Capital Gains Tax?

CGT is a tax that investors must pay beyond a threshold point on profit they make from certain forms of investment. When an asset increases from its purchase value in the period prior to its sale, the gain or profit may be taxable.

You can learn more about CGT at gov.uk, including the items subject to CGT, the rate of tax and tax-free allowances.

Making a return on your investment

Tax implications can arise when selling precious metals. Depending on the value of your sale you may need to pay CGT on the profit you realise on investments. Unlike gold coins, many of which can be purchased tax free, CGT is due on gold bars as they are not a form of legal tender.

In contrast to VAT, which is collected at the point of purchase, CGT is charged at the point of sale. This makes it hard to predict or factor into your investment strategy.

CGT is payable on the profit that you make. Rather than being calculated based on the value of the gold when you buy or sell the gold, the amount you may owe in CGT is based on the difference between these amounts.

Remember that the burden of declaring CGT is on individual investors. If you are unsure what your tax bill should be for the coming financial year, please consult your accountant.

What is the CGT threshold?

CGT legislation at the time of writing (June 2022) allows for a personal exemption allowance on all profits up to £12,300. This allowance is dropping to £6,000 in 2023-2024 and just £3,000 in 2024-2025. This means most smaller investors rarely need to worry about CGT. For larger investors, diversifying your portfolio with CGT-free gold means you can buy higher amounts of gold before paying tax on your profits.

Profit made above the limit is taxed at 10-28% depending on personal taxation rate tiers and the nature of the assets sold.

What are Capital Gains Tax rates?

CGT applies to profits made over the value of the personal exemption allowance. For example, if you made a profit of £20,000 on a 20% CGT liable sale, you would owe £1540 in CGT. For many investors, a profit above the tax threshold is unlikely, however before investing in gold it’s important to consider any deductions that might be made after the point of sale.

The £12,300 tax threshold applies to all investments, so making a profit below the threshold for one item doesn’t mean you won’t eventually have to pay tax if you exceed the limit through further sales in the same financial year.

Different rates apply for individuals and businesses:

- 10% or 20% for individuals (based on income tax brackets).

- 20% for trustees or representatives of a deceased person.

- 10% for sole traders, those in a partnership and qualifiers for Business Asset Disposal Relief.

- 20% for companies.

(Rates for disposal of residential property assets are generally 8% higher.)

How can I buy gold tax free?

A variety of gold coins are CGT-free, specifically British Gold Coins produced by the Royal Mint, which are considered legal tender and therefore outside the scope of CGT.

Both Gold Sovereigns and Gold Britannias have a nominal value, in addition to having a retail and investment value which fluctuates with the current price of gold.

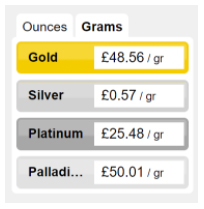

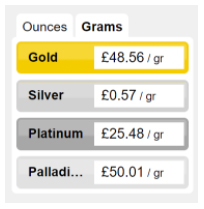

The price of gold can be seen on our website. Below is a snapshot at the time of writing (15th June).

Our most popular tax-free gold coins

The most popular British gold coins include the Gold Sovereign and the Gold Britannia, both of which are internationally sought after by investors.

Top 5 best sellers

The benefits of tax-free gold coins

- Tax-free coins are in high demand due to the higher resale and profit margin compared to some other forms of gold investment. This means they can be easily liquidated.

- Unlike other forms of investment, you won’t face counterparty risks when investing in tax-free gold coins.

- Tax-free gold coins come in a number of sizes and denominations. This gives sellers the flexibility to sell exactly how much gold they want, whenever they want.

- Gold coins are easily authenticated. When you invest in gold coins you know you have the real deal.

- Gold coins allow you to have a balanced portfolio. They come with the added benefit of being small units which can be easily liquidated when required.

- Physical gold has been known as a safe haven store of wealth for millennia, having been turned to by the likes of Pharaohs and Royalty. Gold holds and can increase its value during times of economic downturn.

How to calculate what you owe

If you are still unsure about your liability or potential liability for CGT, particularly if you have a complex asset portfolio have a complex portfolio, it may be worth consulting your tax advisor.

Buy Capital Gains Tax-Free coins today

Visit our British Gold Coins page to see our full list of CGT-free coins for sale. If you have any questions about buying tax-free gold, please do not hesitate to get in touch with our team, who will be more than willing to help. Our opening hours are Monday – Thursday 9am-5pm, Friday 9am-4pm.