The World’s Largest Gold Nations Unveiled

With an estimated market cap of $15.8 trillion, gold has seen almost a 20% increase in value compared to last year. There’s no denying that gold is one of the most sought-after precious metals in the world - but where are the largest gold nations?

More countries are opting to buy gold as it is an attractive investment option, a safe-haven asset, and a hedge against inflation and deflation. This has meant that gold prices have continued to increase over the years.

We uncover the world's biggest gold nations, from the countries with the most gold bars held in central bank reserves to those with the highest gold ETF holdings. We also reveal how to buy and sell gold around the world safely.

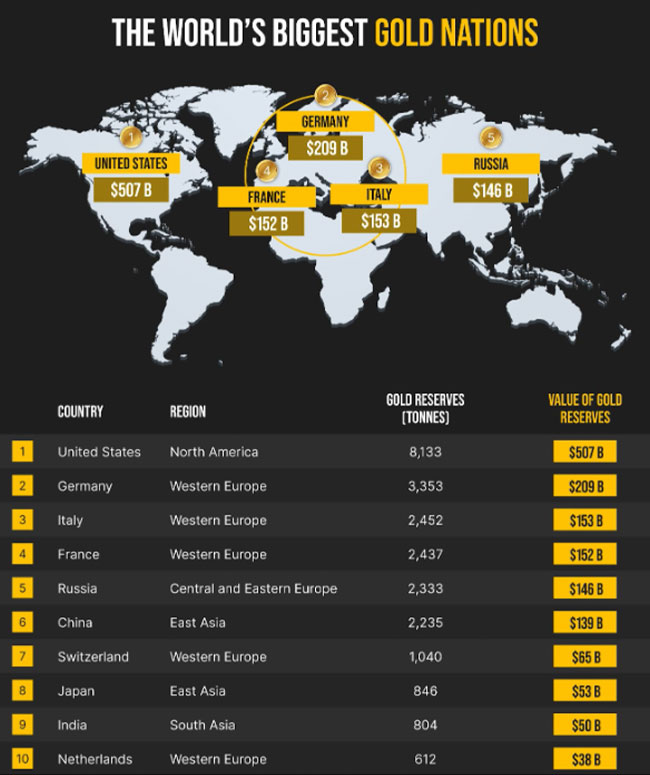

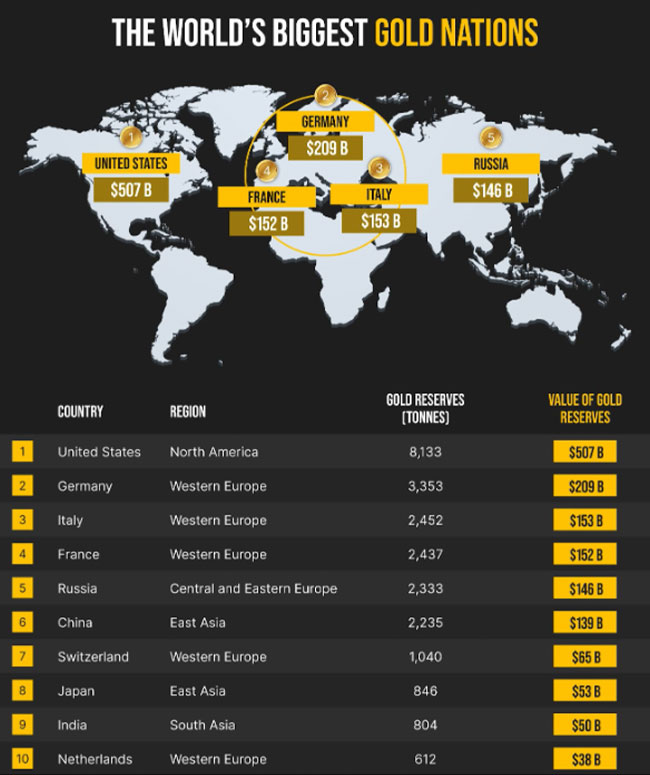

The world’s biggest gold nations

1. United States, North America

Gold Reserves (tonnes): 8,133

Value of gold reserves: $507 B

The United States tops the list with 8,133 tonnes in gold reserves, equating to a whopping $507 billion in monetary value. Retaining nearly as much gold as the following three countries combined, the US has far more gold reserves held by the central bank than any other country on the list. The country’s substantial amount of gold bars and bullion comes as little surprise as the United States is also one of the top gold-producing nations, making it to the top five with 173 tonnes of gold.

2. Germany, Western Europe

Gold Reserves (tonnes): 3,353

Value of gold reserves: $209 B

Germany has the second-highest amount of reserves which includes gold bars and bullion, with 3,353 tonnes worth $209 billion. Over the years, Western European countries have reserved large amounts of gold as a long-term investment and a hedge against future economic uncertainties. Germany also sees gold potential through the value and wealth it provides for upcoming generations, which could explain why it has the third-highest gold ETF holdings (336 tonnes).

3. Italy, Western Europe

Gold Reserves (tonnes): 2,452

Value of gold reserves: $153 B

Italy is the third-largest holder of mined gold bars and bullion held in reserves, standing at approximately 2,452 tonnes. Having a long history of gold ownership and accumulation, Italy has acquired gold through several avenues, including trading, mining and official purchases. Italy is among the most stable countries in the world, with a value of $153 billion in gold reserves held by the central bank.

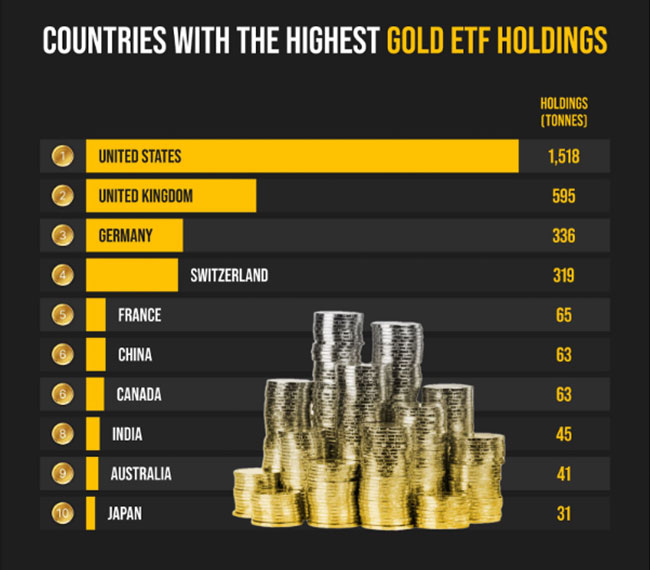

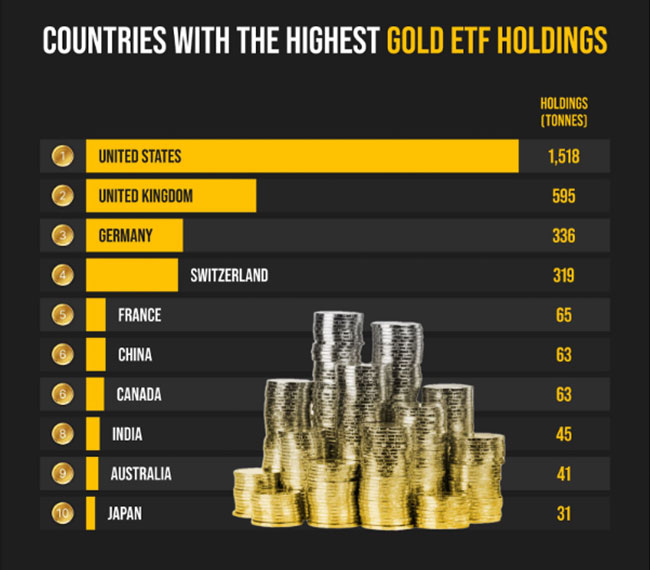

Countries with the highest gold ETF holdings

1. United States

Holdings (tonnes): 1,518

The US has the highest gold exchange-traded funds (ETFs) holdings by far compared to all other countries. The ETF market has been particularly strong in the United States, with increased adoption driven by local tax advantages. Currently retaining 1,518 tonnes in ETF holdings, the country has secured gold ETFs through various investment types, including stocks, bonds and commodities.

2. United Kingdom

Holdings (tonnes): 595

ETFs can conveniently be traded through stock exchanges such as stocks, providing investors with efficient ways to gain exposure to the UK market. As a result, the UK has accumulated 595 tonnes in gold ETF holdings and is among the countries with the highest holdings. This highlights the country’s strong investment culture, with a significant portion of its population participating in various investments, such as equities and bonds.

3. Germany

Holdings (tonnes): 336

Germany completes the top three with gold ETF holdings of approximately 336 tonnes. ETFs received some of the highest among assets invested by German investors, especially as gold is considered a safe-haven asset and is seen as a hedge against inflation and currency devaluation. This has made it an attractive investment option for native investors looking to protect their wealth in the long term.

Regions with the highest gold ETF holdings

Regarding regions with the highest gold ETF holdings, North America takes the lead with 1,581 tonnes, accounting for over half of the world’s total ETF holdings (51%), with countries such as the US (1,518 tonnes) and Canada (63 tonnes) as the biggest contributors.

In recent years, Europe has slowly been following in the same footsteps, making up 43% of the global accumulation of ETF holdings, with the UK (595 tonnes), Germany (336 tonnes) and Switzerland (319 tonnes) as the most significant contributors, among many others.

Asia and other regions have also shown increased interest in investing in gold ETF holdings, with the former accounting for 5% of total ETF holdings while the latter accounts for 2%.

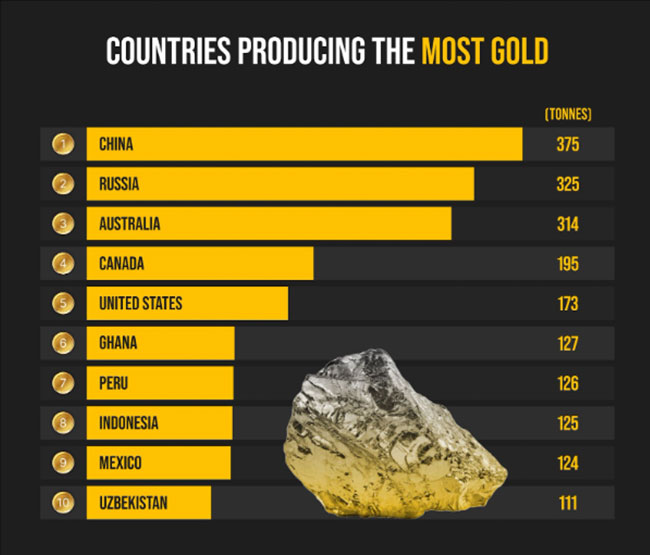

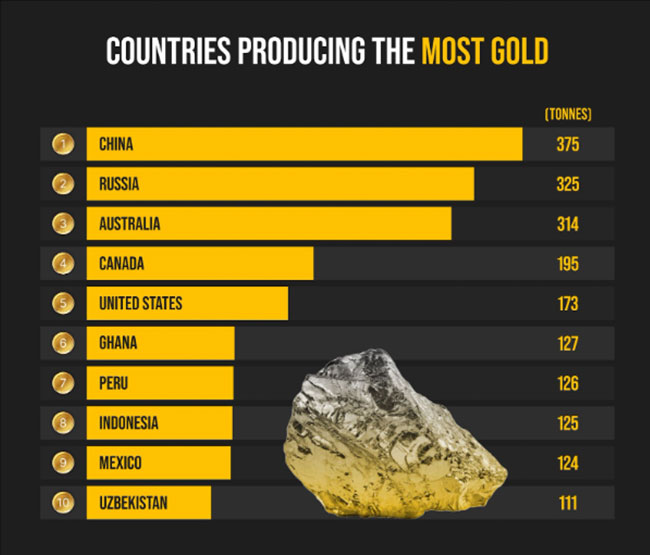

Countries producing the most gold

1. China

Tonnes: 375

China is the largest gold producer in the world, producing approximately 375 tonnes. Over several years, China has remained top of the list due to its commitment to large-scale mining operations, accounting for 10% of the global production of gold in 2022. Therefore, it’s no wonder that the country is also in the top ten for countries with higher gold reserves held by the central bank, with 2,235 tonnes worth as much as $139.5 billion in value.

Part of the BRICS (an intergovernmental organisation consisting of different countries), China has also formed an alliance with other countries to acquire gold at a remarkable rate to shift global demand away from the US dollar.

2. Russia

Tonnes: 325

Russia is the second-largest gold producer in the world, having produced 325 tonnes in 2022. The country has consistently been one of the top gold producers over the years, especially due to the increase in gold investment, which has led to a heightened exploration and extraction of the precious metal. It is also unsurprising that Russia is in the top five countries with the highest gold reserves held by its central bank, having 2,333 tonnes worth $145.5 billion in value, just ahead of China.

Much like China, Russia forms part of the BRICS nations and plays an active role in buying gold, influencing the recent price increases in purchasing the precious metal.

3. Australia

Tonnes: 314

Among the world’s leading gold-producing countries, Australia produced 314 tonnes in 2022. With a well-established mining industry, the country continues to increase its production of gold. Due to its advanced technology and favourable mining regulations, the country is one of the top gold producers in the world, as it possesses significant reserves in the central bank and in untapped reserves.

Additionally, the Australian geological composition is favourable for gold production, allowing for more opportunities for the development of gold deposits in various regions of the country, which also contributes to its overall gold production.

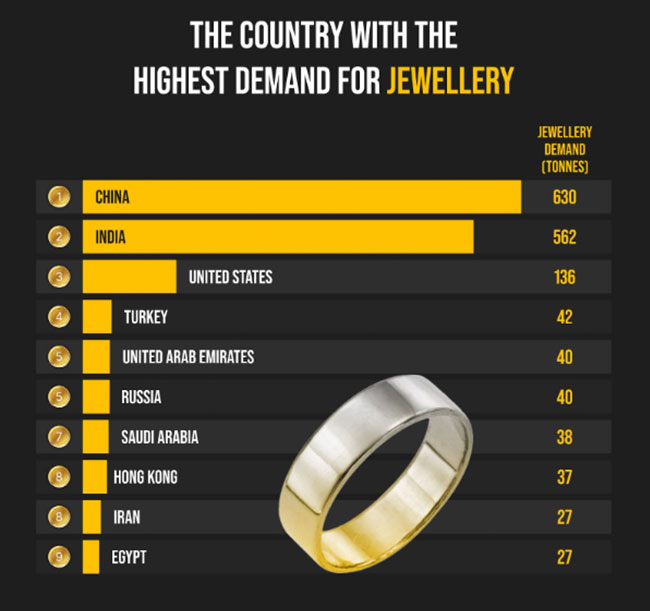

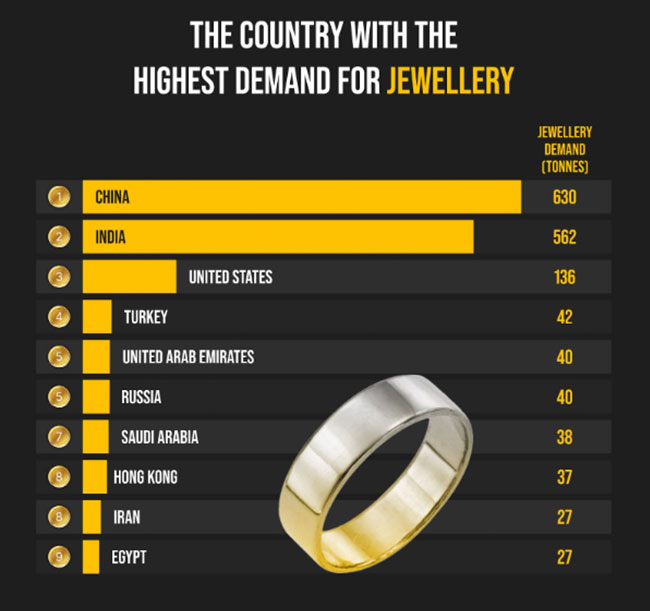

The country with the highest demand for jewellery

1. China

Jewellery demand (tonnes): 630

China has the highest demand for gold jewellery with 630 tonnes, a 10% year-on-year increase. This is unsurprising as the country is the world's largest single market for gold. The precious metal has also seen substantial growth in its role as a safe-haven investment. Gold jewellery also holds deep cultural significance and is seen as a sign of wealth and good fortune, making it a popular asset to purchase.

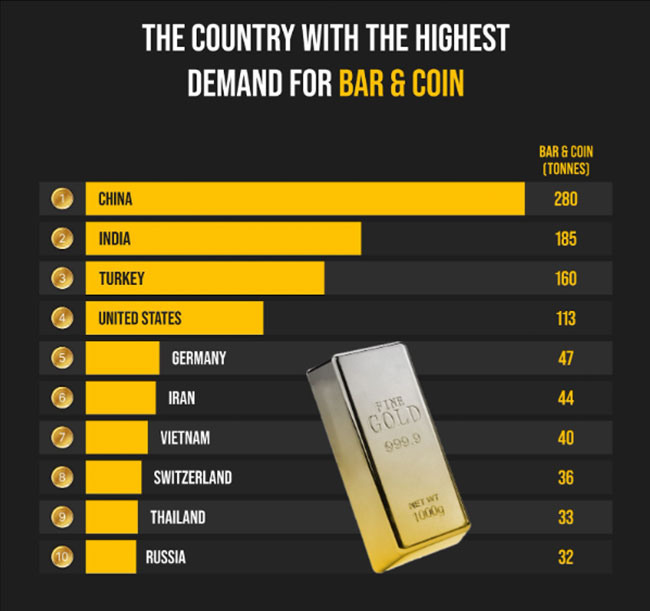

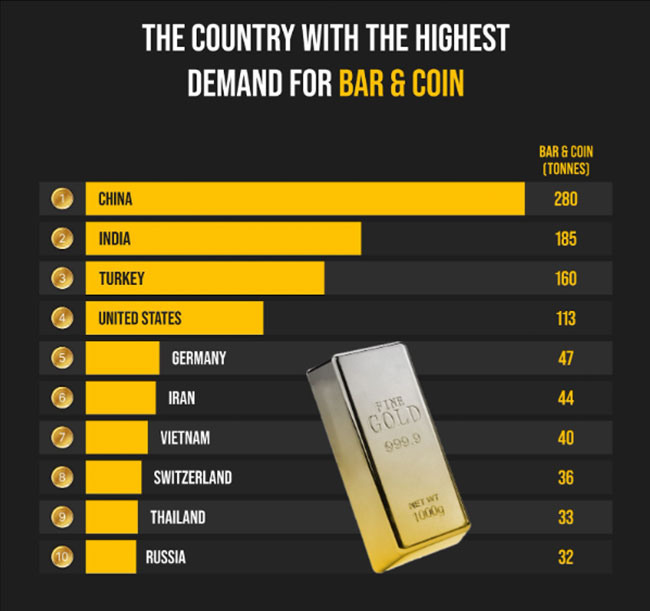

The country with the highest demand for bar & coin

1. China

Bar & coin demand (tonnes): 280

The gold bar and coin sector is in more demand in China than in any other nation. The strong investment demand for gold has naturally led to the popularity of gold bars and coins in the country, resulting in 280 tonnes. Gold bars and coins are seen as tangible assets for investment diversification, making them more popular among Chinese investors.

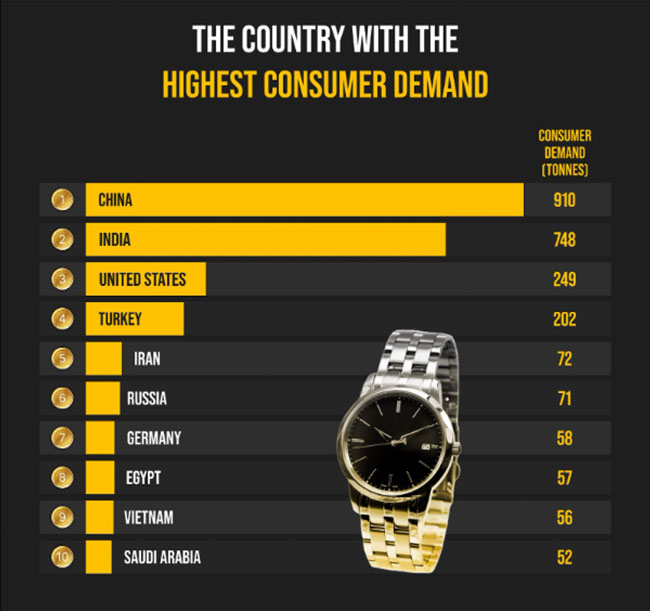

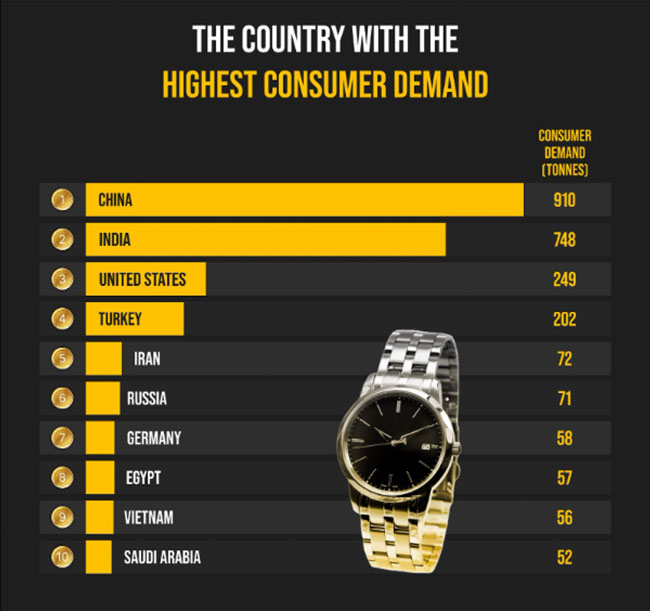

The country with the highest consumer demand

1. China

Consumer demand (tonnes): 910

With a consumer demand of 910 tonnes, China by far has the largest demand for gold compared to other countries. Over the years, China has witnessed rapid economic growth and an increase in affluence, which has resulted in a surge in demand for luxury goods, including gold jewellery, bars and coins, among Chinese consumers as these remain strong and increase in value over time.

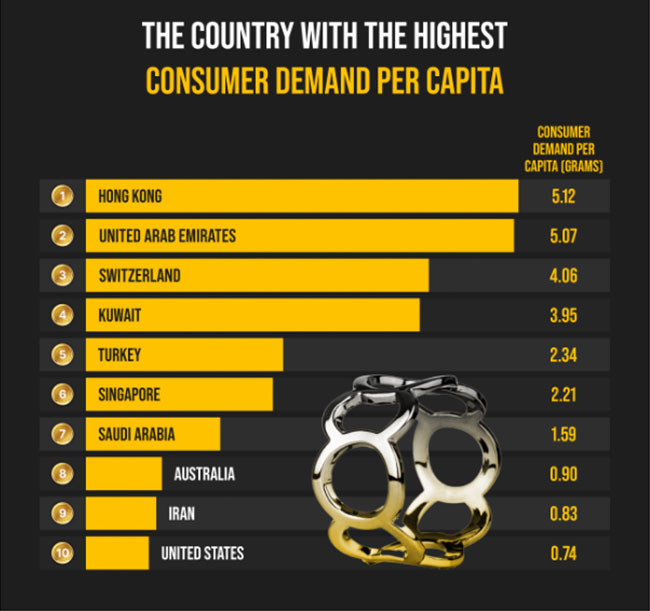

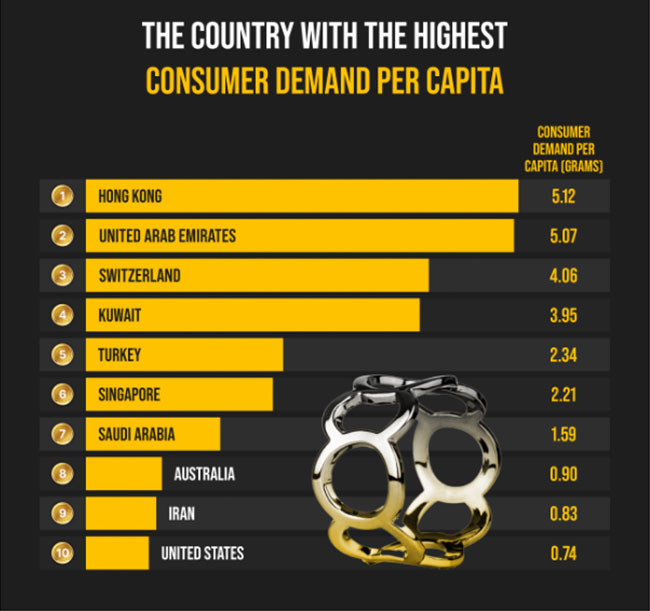

The country with the highest consumer demand per capita

1. Hong Kong

Consumer demand per capita (grams): 5.12

Hong Kong has a consumer demand per capita of 5.12 grams, the highest in the world as of 2023. The current price for gold per gram is almost £601, equating to approximately just over £300 per person.

The East Asian country already has one of the highest GDPs per capita globally, making it a relatively affluent nation. It suggests that people have more disposable income to invest in luxury items such as gold jewellery while preserving their wealthy status.

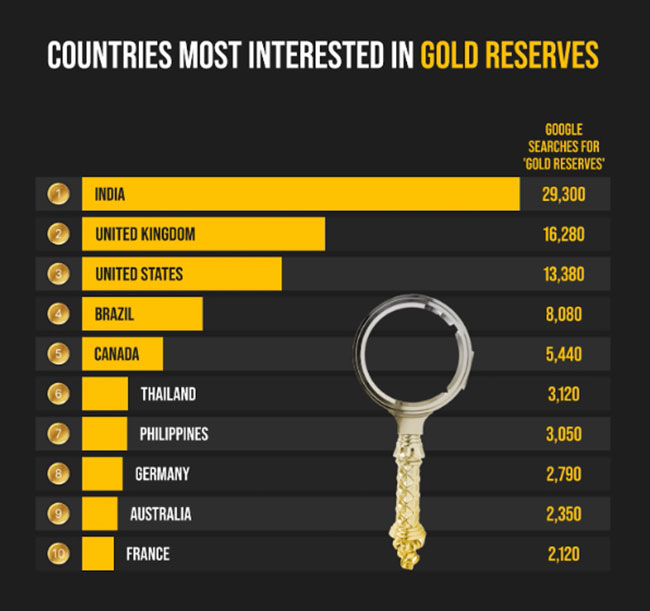

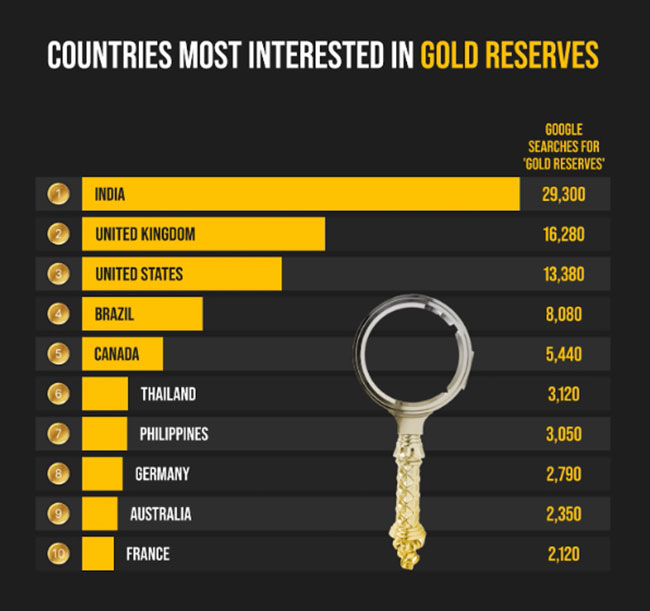

Countries most interested in gold reserves

1. India

Google searches for 'gold reserves': 29,300

India has recently seen the most increased interest in gold reserves, with 29,300 Google searches for the term ‘gold reserves’ as of February 2024. This comes as no surprise as the country is part of the top ten nations with the highest gold reserves in the world. India has approximately 804 tonnes of gold worth a value of $50 billion.

2. United Kingdom

Google searches for 'gold reserves': 16,280

The UK follows behind with 16,280 Google searches, showcasing an increased interest in gold reserves compared to other countries. Though not part of the countries with the most gold reserves, the UK has accumulated a sizable amount of gold worth $19 billion, representing a substantial amount of its monetary assets aiding its economic stability.

3. United States

Google searches for 'gold reserves': 13,380

The United States has also gained a lot of interest in gold reserves, with the term receiving 13,380 Google searches over the last year. As a giant in the gold industry, it is no surprise that the North American country has sustained a solid reputation for accumulating the largest gold reserves in the world (worth $507 billion), with almost more gold than Germany, Italy, and France put together.

Rick Kanda, Managing Director at The Gold Bullion Company comments:

"The world’s biggest gold nations do not thrive solely on their accumulated gold reserves but have devised various metrics beyond that. Countries including the United States, Germany and Italy are among the top holders of gold reserves and continue to grow steadily as a part of their investment diversification strategy.

Regarding ETF holdings, the United States stands out with its significant amount of gold ETF holdings, accounting for more than 50% of the world’s total. However, it is notable that more European countries are following suit, with the UK, Germany, and Switzerland also being large contributors.

A consistent gold producer through the years, China is a major player in the gold production game, producing more than 375 tonnes. China is a key contributor to the global economy, with the most significant consumer demand for assets such as gold, jewellery, bars, and coins.

Overall, understanding the world's biggest gold nations provides a fresh perspective on gold's value and economic benefits."

How to safely buy and sell gold around the world

When looking to buy gold or sell it, taking the time to consider several factors, such as authenticity and reputability, can help ensure your safety. We offer expert tips on the best practices for buying and selling gold.

1. Reputability

Opting for reputable dealers is crucial when buying and selling gold globally. Whether purchasing physical gold or trading ETFs, it is essential to check your dealers are fully accredited and well-recognised in the industry.

2. Understanding market prices

Educate yourself on how gold is priced and compare prices to ensure you get the best possible value for your investment. Price transparency is vital when ensuring you get a fair value for your transaction.

3. Authentication

The buying goal requires a full authenticity check to verify the reputability of your purchase. Therefore, it is advised to avoid purchasing from unverified sources and ensure you have genuine certificates of authenticity, especially for physical assets such as gold coins, bars and jewellery.

4. Diversification

Consider investing in more than one asset class. Diversifying your gold holdings across various forms, such as bars, coins, jewellery, ETFs and more, helps reduce risks and enhance asset stability.

5. Professional financial advice

Seeking professional advice from financial advisors or gold specialists may be beneficial in providing tailored guidance on the best ways to invest your assets based on varying factors such as market conditions, risk tolerance and your financial goals.

Methodology

Using the most recent data from the World Gold Council, we sourced figures on the gold reserves by country, looking primarily at the total amount of gold reserves (tonnes) held by the central bank of each country as of December 2023. These figures were rounded to the nearest whole number. Data collection for this section was completed on 22/03/2024.

We used the yearly average of gold price per troy ounce from the 29th of December 2023 and then converted each country’s gold reserve from tonnes to troy ounces to calculate the value of gold reserves for each country. These figures were calculated on 04/04/2024.

To highlight the nations with the most gold ETF holdings, we looked at the gold ETFs, holdings and flows by country and region to determine the areas with the highest ETF holdings as of the 22nd of March 2024. These figures were rounded to 1 d.p. Data collection for this section was updated on 02/04/2024.

Using data on global mine production, we considered the amount of gold each country produces, measured in tonnes. These figures were rounded to 1 d.p, and the data was taken from the 31st December 2022. Data collection for this section was completed on 22/03/2024.

We used historical demand and supply data from 2023 figures for the following factors:

Jewellery, bar and coin, consumer demand (per tonnes) and the consumer demand per capita (per gram) for each country. These figures were rounded to 1 d.p. apart from consumer demand per capita due to its smaller figures. This data collection was done on 05/04/2024.

To find out which countries have the most searches for the term ‘gold reserves,’ we used Google’s Keyword Planner to take the total number of searches from Mar 2023 to Feb 2024. Figures were collected on 02/04/2024. Please note Russia wasn’t included in this factor due to a lack of available search data.