The True Cost of Everyday Luxuries: What If You Bought Gold Instead?

From a Netflix subscription to a Friday night takeaway, small expenses can quickly add up. But have you ever considered what money spent on non-essentials could be worth if it was invested instead? Many of us spend hundreds, if not thousands, each year on non-essential items like streaming services, alcohol, beauty treatments, and gaming subscriptions. While these purchases provide short-term enjoyment, they don’t hold lasting value.

By contrast, gold has long been a trusted store of wealth, growing in value over time. So, how much could you potentially make if you buy gold bars instead of takeaway coffees and your Netflix subscription?

In this piece, the experts at The Gold Bullion Company will break down everyday non-essential expenses and compare them to potential returns from gold investments. Whether you’re looking to buy gold as a smart investment or considering selling gold you already own, this analysis highlights how small financial choices can significantly impact long-term wealth.

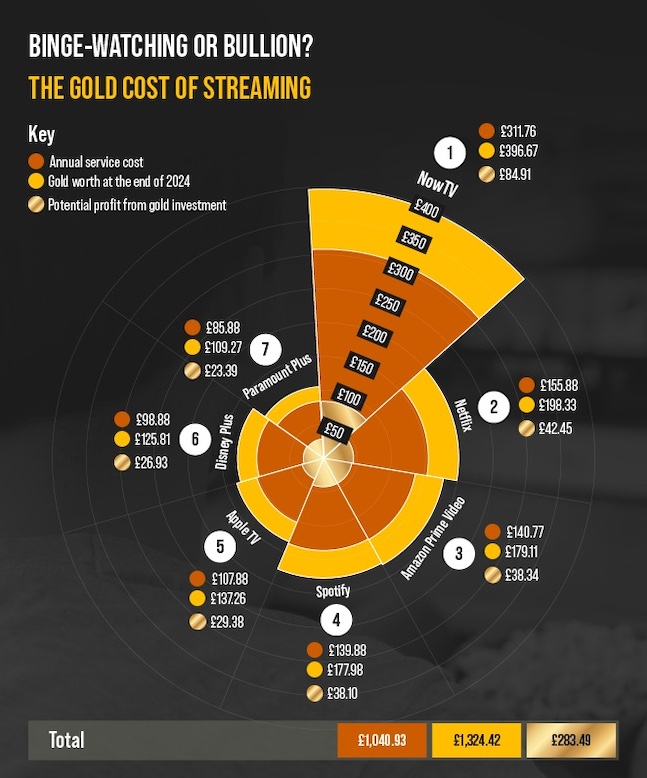

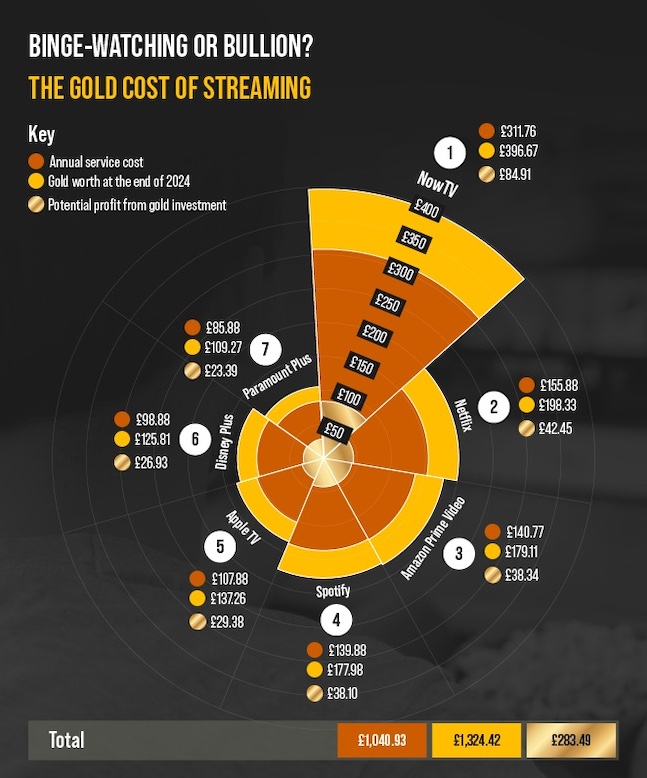

Binge-watching or bullion? The gold cost of streaming

Now more than ever, it is becoming more and more expensive to subscribe to streaming services. Especially if you’re subscribed to more than one to try and maximise how much content you can access. There are also price increases to consider, with Netflix, Disney+ and Paramount+ all increasing their prices recently. We’ve looked at seven popular subscription services and estimated how much you could have earned had that money been invested in gold at the start of 2024.

The annual cost across these seven services is around £1,040, which, if invested in gold at the beginning of the year, could have been worth £1,324.42 at the end.

NowTV subscribers could have seen the biggest earnings had they invested the cost of their subscription in gold. Currently, the service costs £9.99 each for the movie and entertainment pass, with an additional £6 to go ad-free, totalling nearly £26 monthly.

Netflix is the streaming service that will give you the second biggest return on gold investments, seeing people make a potential profit of £42. Following Netflix are Amazon Prime Video and Spotify, earning a potential gold investment return of £38.34 and £38.10, respectively.

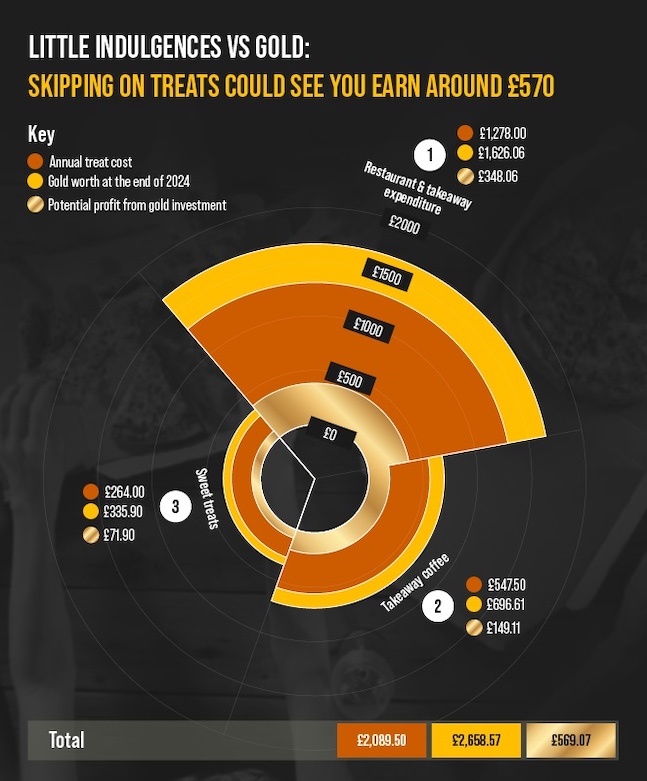

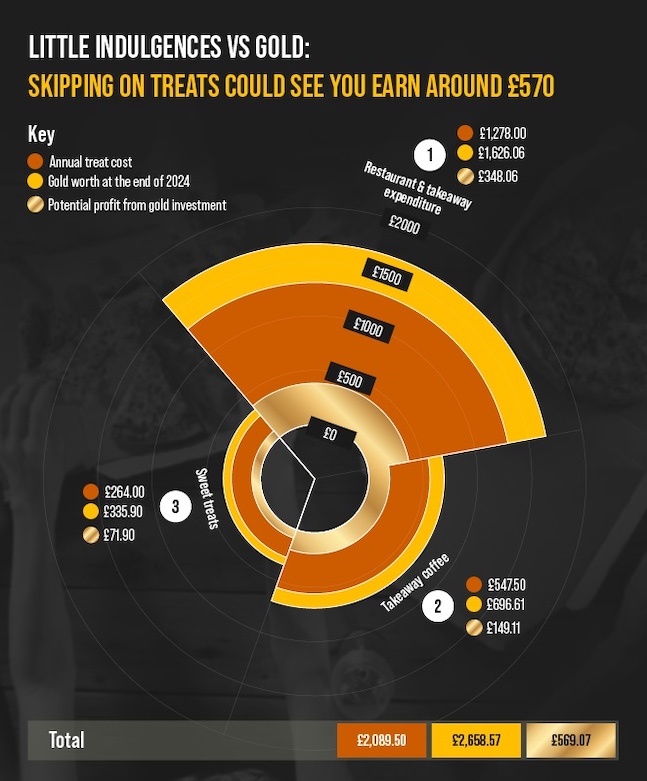

Little indulgences vs gold: skipping on treats could see you earn around £570

You may wonder whether it is worth cutting back on the occasional sweet treat or takeout coffee. Restaurant and takeaway expenditure is the biggest indulgence that could potentially earn you the most if you cut back and invested in gold instead. On average, households spend £1,278 annually on takeaways and eating out. If invested in gold at the beginning of 2024, that would give you around 0.781 ounces of gold and by the end of the year, that would be worth around £1,626 for a profit of almost £350.

Additionally, people in the UK have an average of three takeaway coffees a week, priced at around £3.50 each for an annual spend of £547.50. If this had been invested in gold, it could have been worth almost £700, for a profit of nearly £150. Sweet treats, however, offer the smallest return on investment in gold, earning you a profit of around £72 by the end of 2024.

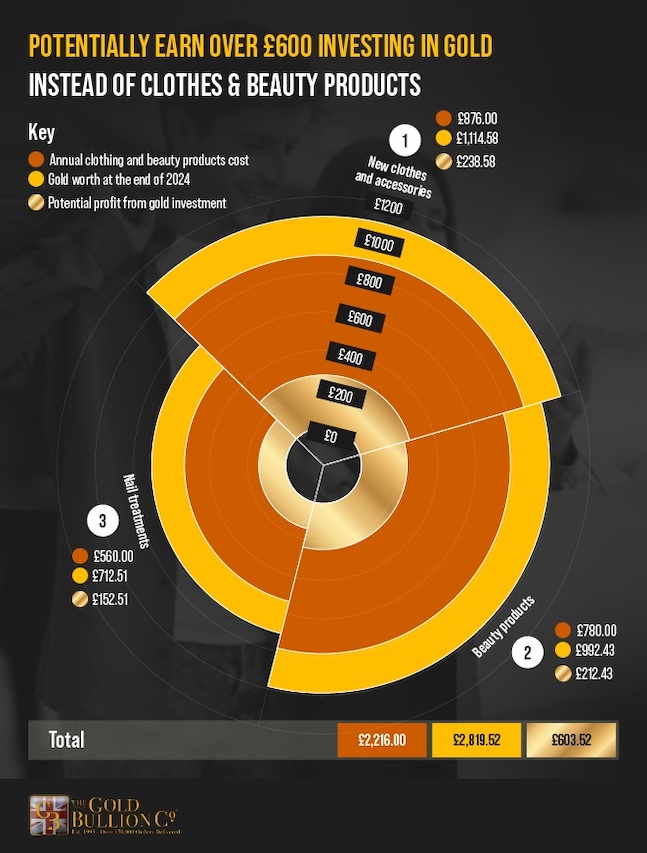

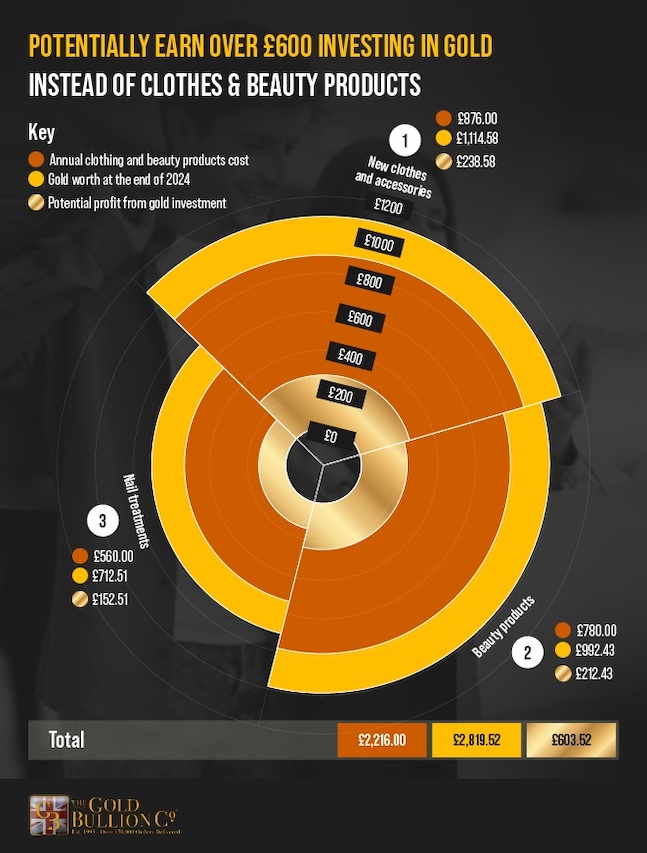

Potentially earn over £600 investing in gold instead of clothes & beauty products

Average expenditures on new clothes, beauty products, and nail treatments total £2,216 over the course of a year. If this amount had been invested in gold at the start of 2024, it could have purchased 1.353 ounces of gold, which by the end of 2024 would be worth £2,819.52—yielding a profit of £603.52.

The biggest culprit here is new clothing and accessories, with people admitting to spending £73 monthly, totalling £876 across the year. Nail treatments are the least extravagant expenditure in this category, with people spending just £560 annually. However, had these annual expenditures been invested in gold, they could have potentially profited consumers by £238 and £152, respectively.

This highlights how habitual spending on personal appearance, while enjoyable, comes at the opportunity cost of potential financial growth. Underscoring how even relatively modest lifestyle adjustments could translate into substantial investment gains over time.

The profits you could make investing in gold instead of gaming products

The gaming industry is a massive driver of entertainment spending, with subscriptions and new game purchases making up a significant portion of non-essential expenses. For example, an Xbox Game Pass Ultimate subscription, costing £167.88 annually, could have purchased 0.103 ounces of gold at the beginning of 2024—worth £213.60 by the end of that year, with a potential profit of £45.72. Similarly, a PlayStation Plus Premium membership and the cost of buying the top five best-selling PS5 games for the year would have yielded £32.68 and £79.24 in profit, respectively.

While gaming provides entertainment and value, this highlights the opportunity cost of digital subscriptions and game purchases. Investing these funds into gold instead would have resulted in tangible financial gains within just a few months.

Pints or Profits? The Gold Price of Your Weekend Drinks

Everyone likes a drink from time to time, especially given the pub culture in the UK, and social drinking especially can benefit a person's mental well-being. That said, a weekly £5.75 spent on Blossom Hill wine adds up to nearly £300 annually—an amount that, if used to buy gold at the start of 2024, would be worth £381.48 at the end of the year, generating an £81.66 profit. Similarly, a weekly four-pack of Stella Artois, costing £6.25, equates to £325.89 per year. Had that money gone into gold instead, its value would have risen to £414.65, producing an £88.76 return.

For those who regularly spend on nights out, the impact is even more striking. The average annual pub and bar expenditure of £1,460 could have grown by nearly £400 had it been converted into gold rather than spent on drinks. This underscores the hidden potential of discretionary spending and how investing in gold can turn routine expenses into valuable financial assets.

Methodology -

We created a list of common non-essential items that people in the UK purchase. For subscription services, we recorded the price of the cheapest ad-free tier available. We then recorded the price for each item in 2024 and calculated the annual spending of each item where needed.

Nail treatments

New clothes and accessories

Beauty products

Xbox Game Pass Ultimate

PlayStation Plus Premium

Top 5 best selling PS5 games 2024:

Annual household restaurant & takeaway expenditure

Takeaway coffee

Sweet treats

Netflix subscription

Amazon Prime Video subscription (plus £2.99 for ad-free)

Disney Plus subscription

Apple TV subscription

NowTV subscription

Paramount Plus subscription

Spotify subscription

One bottle of Blossom Hill wine

Stella Artois 4-pack

Annual pub/bar expenditure

In 2024, Xbox Game Pass Ultimate, Amazon Prime Video, Disney Plus, Paramount Plus, and Spotify subscriptions saw price rises. As such, we took the price for each month (January–December) for these services and then added the 12-month total to get the annual expenditure.

We then used The Gold Bullion’s “Five Year Gold Price in GBP per Ounce” to take the price of gold on 02/01/2024 and 31/12/2024 to calculate how much each annual expenditure would have been worth if used to buy gold at the beginning of 2024.