How to Exploit Gold Bullion Price Fluctuations?

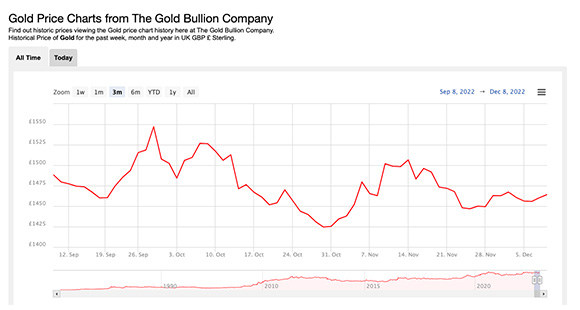

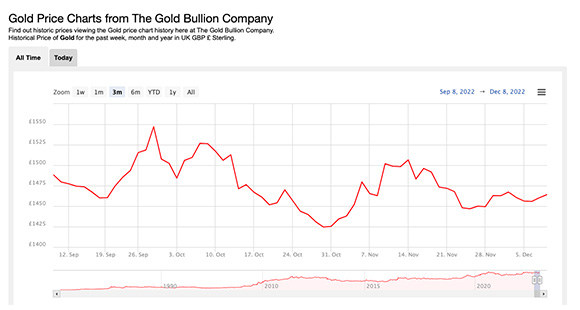

Gold bullion is experiencing a slight downward faze over the past few weeks, as it corrects from its previous highs. In the past month, the price has dropped by nearly £20 per ounce. But the course over the long term has remained positive.

Many investors watch the markets closely to enable them to take advantage of these small changes. For retail investors it is not usually as profitable to trade on a difference of a few pence per gram, however, the swings within the month can add up to substantial savings for retail buyers of gold bullion from companies such as https://www.thegoldbullion.co.uk.

Tips for buying investment grade bullion

If you are buying investment grade bullion, you shouldn’t be really buying it for its pleasing aesthetic qualities, but to realise the maximum profit from the increase in prices.

Whilst you may wish to mark your move into gold with a symbolic purchase, if you are buying gold as an investment, then you should really be looking to maximise profit rather than anything else.

After all, all 24k gold is equal in value per gram, any extra charges are purely down to brand-driven concerns or decoration.

Buying gold by weight

One thing to consider when buying gold is that you usually get a better price per gram when you are buying larger bullion bars. This is to do with the manufacturing, packing and shipping costs of retail gold bullion bars.

It is much easier to make large, plain undecorated blocks of gold than it is to make many smaller blocks. This is true from both the manufacturing side and from retail and all the other points in between. As the size of your block purchase increases, you will see a decrease in the cost per gram, the margin between the retail price and the raw material prices will narrow quite considerably.

From an investment point of view, it may well be better to save up so that you can purchase a larger amount later. Even if the price has risen, there is a good chance that you may still get a better deal.

Where do I get the latest gold price?

The London Gold Fix is the setting of the price of gold that takes place via a conference call. This sets a benchmark for gold twice each day at 10:30 AM and 3 PM. It is designed to fix a price for settling contracts between members of the London bullion market, but the gold fixing informally provides a recognized rate that is used as a benchmark for pricing the majority of gold products.

The current participants include Barclays, the Bank of China, Goldman Sachs, HSBC, and UBS.

Whilst the gold fix provides a benchmark, the price of gold varies across the day as markets open and close around the world. You can see a variety of charts of both historic and live prices related to the gold price and the prices of other precious metals on the website of The Gold Bullion Company. The price of gold bullion available from The Gold Bullion Company will always be based on the spot price, a constantly fluctuating price derived from numerous inputs from throughout the market. This minute by minute price fluctuation in the market can give a good overview of how the next fix will be priced.

As well as live prices, we offer an array of data on the price going back to 1970. You can find our precious metal price data pages at the following web addresses: