How Does Gold Compare With High Street Savings Accounts?

With interest rates fluctuating and economic uncertainty rising, many people are looking to diversify their savings and researching ways to save outside their regular bank accounts. The search for safe, secure, and reliable alternatives has brought gold back into the spotlight. Not as a luxury, but as a legitimate savings strategy.

The experts at The Gold Bullion Company collected data on gold prices over time and account interest to compare how much profit you could earn by putting £1,000 into a standard high street savings account versus investing that same amount in gold.

Buying gold could result in almost 250% more profit than a savings account

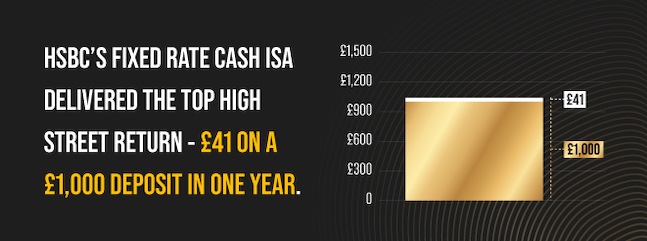

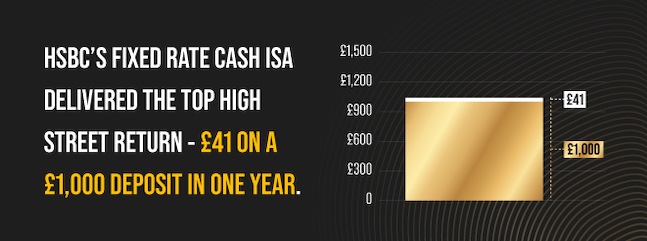

How much could you make if you put £1,000 in a traditional savings account, leave it to rack up interest, and withdraw your savings at the end of one year? We looked at interest rates across savings accounts in April 2025 and compared this to the increase in gold value between April 2024 to 2025.

The highest return from a high street savings product was from HSBC's Fixed Rate Cash ISA, which had a profit of £41 on a £1,000 deposit after one year. Other competitive accounts include Nationwide's Flex Instant Saver (£30) and Barclays Reward Saver (£24.10). At the other end of the scale, some accounts earned as little as £11.

Now compare that to gold. Over the same period, the price of gold increased by almost 32%. After accounting for dealer fees — 3% on buying and 3% on selling — an investment of £1,000 in gold would have yielded a profit of £249.82. That's a nearly 25% gain in just one year.

To put that in context, gold delivered over six times the return of even the best-performing savings accounts. The difference between the gold profit and savings account interest was as high as £238.82.

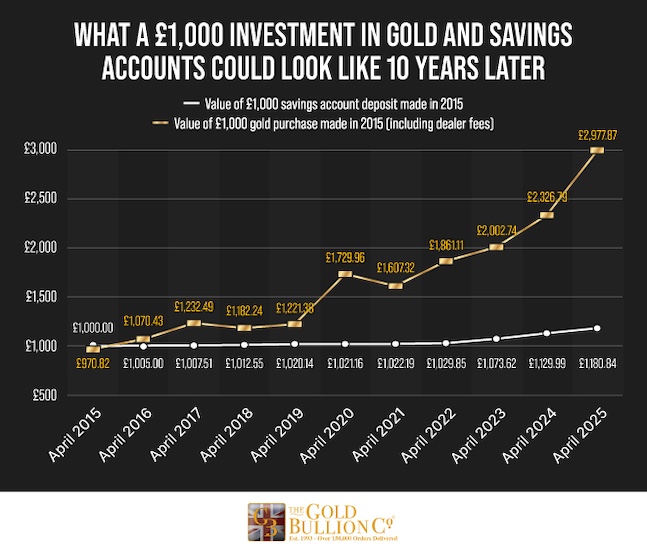

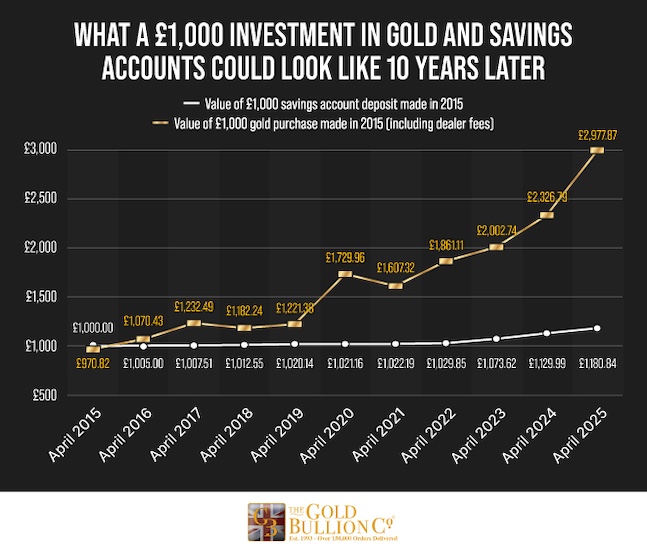

What a £1,000 investment in gold and savings accounts could look like 10 years later

We've used the Bank of England's base rate and the price change in gold to find the potential profit of both over 10 years. However, it's important to note that while this base rate does influence savings account interest across the UK, some banks will opt to offer a higher or lower rate.

If you invested £1,000 in a traditional savings account back in April 2015, you'd have earned modest returns over the decade. Your savings account would now be worth £1,180.84, a profit of just under £181 after 10 years.

Gold is a long-term investment strategy that has historically proven beneficial for patient investors. If you had bought £1,000 worth of gold in April 2015 (worth just under £971 when accounting for purchasing fees), your investment today would have grown to almost £2,978, even after paying the dealer's fees involved in selling gold.

This is a profit of nearly £1,978 over the 10 years, nearly 11 times the return of a typical savings account.

What to keep in mind when investing in gold

As promising as gold can be, it's not without considerations. Like any asset, it's subject to price fluctuations. There are also practical costs to consider. Secure storage, for example, usually costs around 0.65% of the gold's value per year (plus VAT). Also, while we've included typical dealer fees in our calculations, you need to ensure you are buying from a reputable company to avoid impacting profits.

Different types of gold also come with different tax implications. Bars, coins, and ETFs can be treated differently in terms of capital gains tax (CGT) and VAT, so it's worth understanding the ins and outs before purchasing. Britannia coins are a great investment to explore as they offer tax-free gains for UK residents.

On the flip side, savings accounts also come with caveats. Many have enticing AERs and promotional periods, but only deliver if no withdrawals are made. Others cap the amount you can earn interest on. And while your savings are protected up to £85,000 under the FSCS, returns can be low and may be taxed depending on your income bracket.

Methodology

We made a list of regular savings accounts and cash ISAs at five different UK high street banks. This only included basic accounts that give you anytime access to your savings.

We then recorded each account's current AER% and calculated the profit made from the interest, supposing an account holding £1,000.

After this, we recorded the cost per ounce of gold from April 2014 to 2025 using The Gold Bullion Company's live gold price tracker.

We then took the Bank of England's base rate in April every year from 2015 to 2025. We used this to find the compound profit that would be made if £1,000 was deposited in April 2015 and left until April 2025.

The above data was used to estimate the profit from savings accounts vs. gold investment. To account for the dealer's fees associated with gold investment, we added 3% onto the initial gold purchase cost and subtracted 3% from the final gold value.

Lastly, we recorded the Trustpilot review scores of these banks.

All data was collected in May 2025 and is correct as of then.

Note: All calculations used precise numbers, but the final figures are rounded to two decimal places.