To say silver has been behaving oddly recently is something of an understatement.

What’s in a ratio?

Watching the ratio between silver and gold is seen by many investors as a good way of predicting whether either is about to experience a sharp spike or drop in price. The logic goes that if one suddenly becomes much more expensive, relative to the other, then a correction should soon occur – creating volatile changes in price.

With silver being the historically more volatile of the two metals, it’s generally silver that jumps or falls. This is precisely why investors are now looking so carefully at this ratio.

The average price ratio between gold and silver so far for 2018 is 79:1 – higher than it’s been at any point since 1993. And since gold has barely moved in price over the last year, it’s most likely that silver is, once again, the real culprit here.

A high ratio means the price of silver, relative to gold, is much lower than it usually is. For this to ‘correct’, either the price of silver will have to rise or the price of gold will dramatically fall. So is silver about to soar?

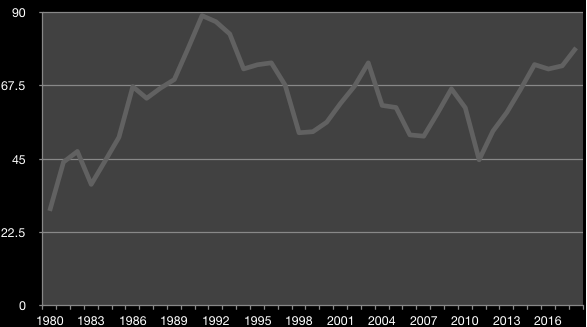

Silver and gold: historical ratio

There’s an old saying among the precious metal community that the rightful ratio between gold and silver prices is 16:1. Whatever the price of silver is, it would follow that gold should be about 16 times the price.

In reality, that hasn’t been the case for decades. In Sterling, we haven’t seen a ratio lower than 29:1 since before 1980. In fact, the ratio generally sits between 50:1 and 70:1 – a significant amount more than the 16:1 figure that usually gets thrown around.

You can see the ratio of gold to silver between 1980 and 2018 on the chart below:

Source: https://www.gold.org/ & https://www.quandl.com/

As you can see, the ratio in 2018 is a lot higher than it usually is. And historically when the ratio has risen in the past, it typically falls once again shortly after.

By no means is this a guarantee. With the Brexit factor, higher geopolitical tensions than we’ve seen in decades, and a whole range of uncertainty in the contemporary financial markets – we’re certainly in uncharted territory here. But if historical data is to be trusted (and we think it is), then silver could well be about to soar.

Silver volatility

But the gold and silver ratio isn’t the only thing that’s out of the ordinary right now. Historically, silver has always been the more volatile of the two precious metals. To avoid delving into complicated facts and figures, the supply and demand of silver tends to be more variable than gold, since it’s used more for non-investment purposes.

The curious thing about silver currently, is that its volatility rates have been much lower over the past few years than has been historically the case.

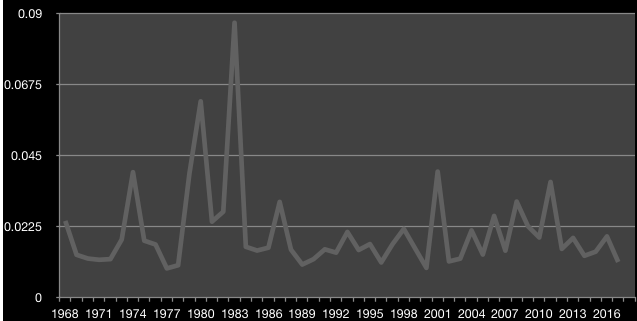

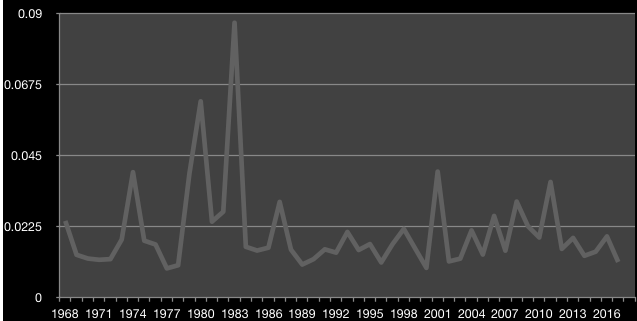

The following chart maps the average annual volatility of silver since 1968. This is the amount by which the average price changes year on year – not the raw price itself, which you can see over on our silver price charts.

Source: https://www.quandl.com/

Average volatility over the last full annual trading period (2017) sat at its lowest point since 2000. So, not only is silver much cheaper compared to gold than it normally is, but its raw price is also moving much less.

What comes next?

There’s every chance that these figures simply mark a long term change in the relationship between gold and silver and the volatility of precious metals. The rules of financial markets are certainly less fixed now than they were before 2008.

But the fact that silver is behaving out of the ordinary by both metrics is raising eyebrows across precious metal markets. It might not explode tomorrow, but there’s every chance that these abnormalities will correct over the next few weeks or months. And if it does, you’ll certainly want to have some precious silver deposits to cash in on.

VAT free silver

Gold bars, bullion and coins are subject to a blanket VAT exemption. Unfortunately, silver is not.

This has been a source of frustration for precious metal investors for some time, as it means the price of silver must rise by at least 20 per cent before any investor can hope to make any returns.

Silver’s historic volatility would otherwise lend itself to a healthy short-term trading market, as investors seek to capitalise on the short-term peaks and troughs in its price. In current trading conditions, this is impossible.

The Gold Bullion Company has recently offered a way around this. Silver which is bought, but not delivered, remains held in a secure, protected LBMA vault, for which VAT remains exempt unless the buyer chooses to have the physical product delivered.

If the silver owner keeps the physical product in the vault for the entire length of ownership, then no VAT will be payable – meaning you can begin to make returns from the entire proportion by which silver appreciates in price.

If a large silver spike is indeed imminent, then this could allow investors to maximise potential returns.

Contact the Gold Bullion Company to find out more.

Check out our full range of silver bars and silver coins if you, like us, think the time is ripe for a silver investment.